E-commerce in India has witnessed an uptick of 77% between 2020 and 2021, and tier 2, 3 cities are transacting more than ever as per a report by the conversation media platform Bobble AI. It also revealed that while tier 1 cities dominate the fashion festival figures, transactions in tier 2 cities like Jaipur, Guwahati, Lucknow, Kochi, Mysore, and Bhubaneswar are at an all-time high – up 82 percent over the previous year.

Apart from that, the majority of consumers are between the ages of 26 and 35 accounting for 37 percent, and between the ages of 18 and 25, accounting for 26 percent with 72 percent males and 28 percent females. According to the data intelligence company’s survey on the state of eCommerce in India, which was conducted across Tier 1, 2 and 3, beauty e-commerce apps usage grew by 64 percent, whereas fashion e-commerce grew by 368 percent over the past year. The festive period has only led the two e-commerce domains to skyrocket, with at least two transactions completed by shopaholics during the fashion festivals.

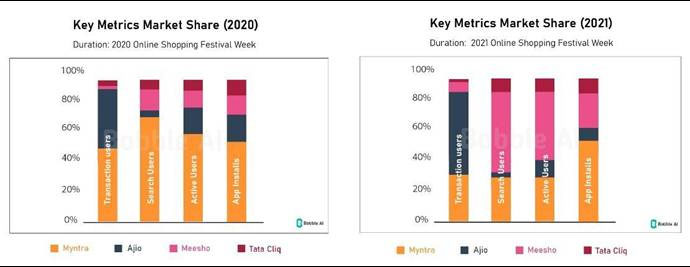

According to the survey, India’s fashion e-commerce sector has shifted from ‘Monopoly’ to ‘Ludo.’ Myntra faced stiff competition from its competitors, Meesho, Ajio, and TataCliq. While Myntra accounted for over 46 percent of all purchases during the 2020 festive season, Ajio accounted for nearly 69 percent of all transactions in 2021. The share of Myntra’s active users who also use Meesho, Ajio, and TataCliq has climbed significantly this year.

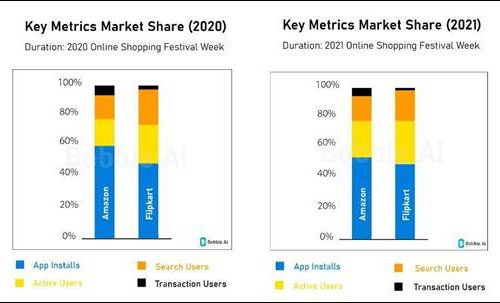

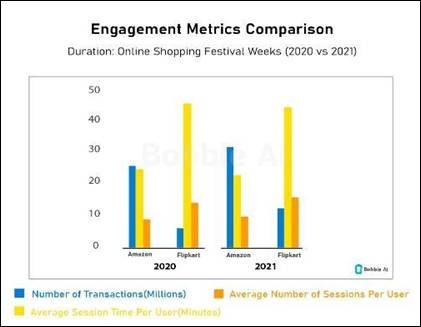

The battle between the e-commerce like, Amazon and Flipkart is noteworthy, with Flipkart’s active user base increasing 83 percent in the 2021 online shopping festival compared to Amazon’s 72 percent. Despite the fact that Flipkart dominates engagement metrics like as search frequency and active sessions, Amazon wins in terms of purchases, with substantially shorter average session times.

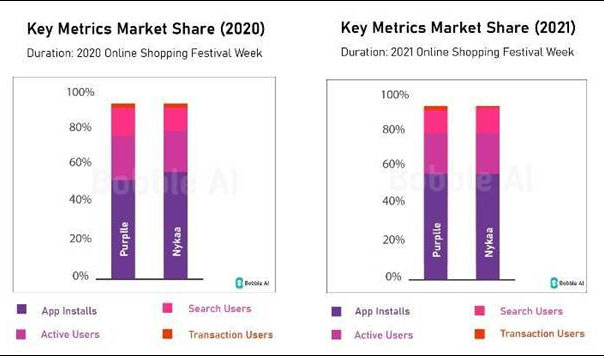

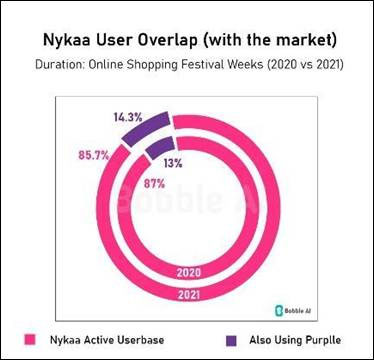

In addition to fashion e-commerce, important findings have surfaced from the beauty e-commerce segment. Nykaa and Purplle clashed this holiday season. In light of Nykaa’s IPO, consider their market share in comparison to Purplle, Nykaa’s pure-play fashion e-commerce competition. Purplle had a 70 percent rise in active users during the 2021 shopping festival, while Nykaa saw a 50 percent increase. Purplle’s common user base has increased from 15 percent in 2020 to 17 percent in 2021.

The festive season trends point towards healthy and fast-evolving competition in the e-commerce market, which bodes well for customers who are looking for high-quality products at affordable prices. With the festive season coming to a close, it is exciting to anticipate how the competition will pan out in 2022. With India’s e-commerce market set to reach $120 billion by 2025, the future seems promising. Hypergrowth is definitely on the horizon for the segment, and according to Bobble AI’s findings, brands are poised to capture growth opportunities.

Latest Technology News Today – Get Latest Information Technology Updates and Services Latest Technology News Today – Get Latest Information Technology Updates and Services

Latest Technology News Today – Get Latest Information Technology Updates and Services Latest Technology News Today – Get Latest Information Technology Updates and Services