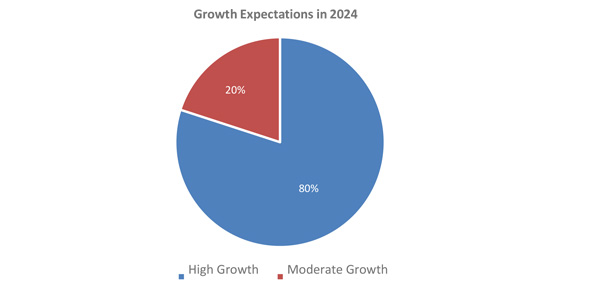

The IT channel isn’t just riding the digital wave; it’s piloting it. This is the resounding message from the Channel Outlook Survey 2024, a comprehensive study of 150 enterprise channel partners and solution providers. With a staggering 80 percent anticipating substantial growth in 2024, the channel’s optimism is palpable

Amit Singh

The IT channel in 2023 was a story of resilience and reinvention. While a lingering pandemic and global economic turmoil tested its mettle over the last 2-3 years, it emerged not just unscathed, but surging, fueled by unprecedented digital transformation demands. Indeed the enterprise channel partners and solution providers have expressed high optimism about the year ahead as the majority of them saw organizational growth in 2023 meeting their expectations and even exceeding their expectations.

According to 150 enterprise channel partners and solution providers who participated in the recent Channel Outlook Survey 2024, 60 percent of the respondents were satisfied with their performance in 2023, moreover, over 33 percent said that their performance exceeded their expectations. Now, as we stand at the cusp of 2024, the question isn’t “if” the channel will grow, but how it will navigate the ever-evolving landscape.

Dynamic Landscape of the IT Channel in 2023

The heartbeat of the IT channel in 2023 echoes a narrative of success and adaptability. A comprehensive analysis of overall performance reveals a landscape distinguished by dynamic strategies and robust revenue growth.

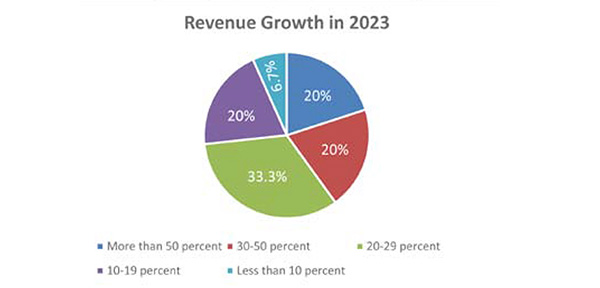

The numbers sing a triumphant melody, with a staggering 73 percent of solution providers marking an impressive revenue growth of 20 percent and above in 2023. Furthermore, 20 percent of respondents witnessed a remarkable surge, experiencing more than a 50 percent increase in revenue.

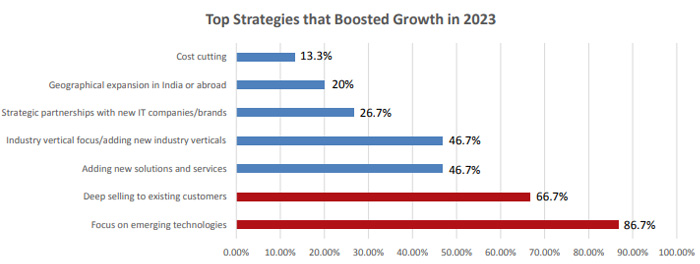

Strategies that focused on emerging technologies and deep selling emerged as the top drivers of growth for solution providers. A remarkable 86 percent of partners identified ‘focus on emerging technologies’ among the key strategies contributing to growth in 2023, while 66 percent favored ‘deep selling to existing customers’ as their preferred strategy for the year. Additionally, 46 percent of partners considered adding new solutions/services to their portfolio and industry vertical focus as instrumental strategies for achieving growth.

Navneet Singh Bindra, Senior Vice President and Chief Country Executive at Ingram Micro India, commented on the growth, stating, “The Indian IT channel and solution provider ecosystem have experienced significant growth in 2023, driven by expansive digital transformation across verticals and rapid technological innovation. Businesses are increasingly investing in customized solutions to meet the rising demands of customers.”

Ranjan Chopra, MD & CEO of Team Computers, attributed their success to a focus on customer-centric solutions, leading to increased client satisfaction and repeat business. He shared, “We have expanded our client base, forged strategic partnerships, and successfully executed projects that positively impacted our clients’ businesses. With revenues reaching Rs 3500 crore, we now aim to become a billion-dollar company in the next two years.”

B Chandrashekar, Chief Business Officer at Futurenet Technologies, emphasized the organic performance of their organization, with existing customers showing continued trust. He said, “Being a preferred Managed Services Partner, our reliability and trust have been core factors for our growth. Our unique IT assessment framework, PASS, providing a complete health check of the customer’s IT landscape, has contributed to our success.”

Cloud, Security, Data Centers: The Trinity Fueled Explosive Growth in 2023

Cloud solutions, cybersecurity shields, and robust data centers became the guiding stars in 2023, illuminating a path of explosive growth for solution providers grappling with the demands of remote workforces and evolving cyber threats. This wasn’t merely a quantitative leap; it marked a qualitative shift, showcasing a channel adept at reading the market’s pulse and adapting accordingly.

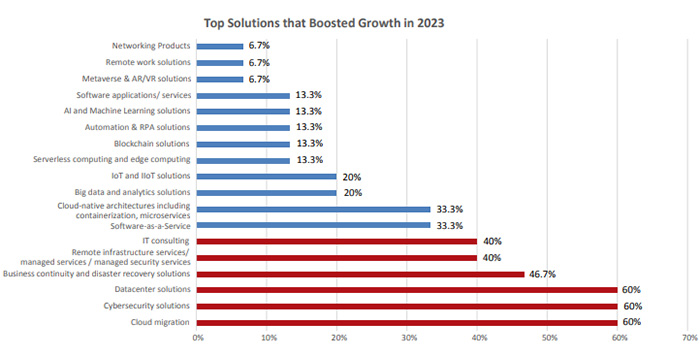

In a resounding chorus, 60 percent of respondents identified cloud migration, cybersecurity solutions, and data center solutions as the top growth enablers. Business continuity and disaster recovery solutions also played a crucial role, boosting growth for over 46 percent of respondents. Managed services, including managed security services, and IT consulting emerged as valuable allies, with 40 percent of partners citing them as key drivers.

Furthermore, over 33 percent of respondents turned to software-as-a-service and cloud-native architectures as their solutions of choice in 2023, solidifying the cloud’s central role in the IT landscape.

Paresh Shah, CEO of Allied Digital Services, echoed this sentiment, attributing their success to “a globally expanded funnel and a focus on digital workplaces, enterprise infrastructure management, cloud, cybersecurity, and our ADiTaaS SaaS platform.” He further highlighted the effectiveness of their “cybersecurity offerings like SOC-in-a-box and Vulnerability Management services.”

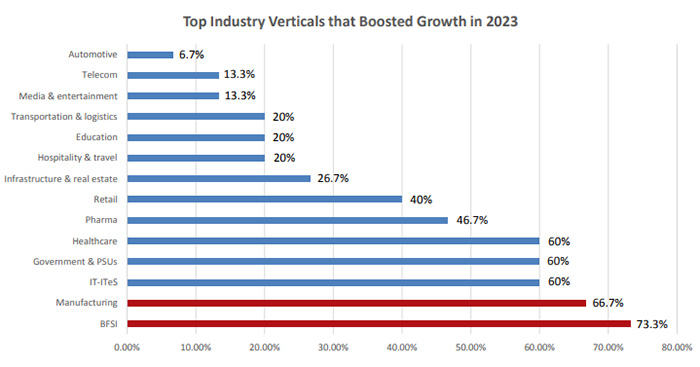

Industry verticals like BFSI, manufacturing, IT-ITeS, government & PSUs, and healthcare emerged as gold mines for solution providers, with over 73 percent citing BFSI as a top contributor to their 2023 growth. While manufacturing significantly boosted growth for over 66 percent of partners, 60 percent found success in IT-ITeS, government & PSUs, and healthcare.

Neel Shah, Chairman of Insight Business Machines, emphasized the importance of industry-specific solutions, stating, “We deciphered the digital DNA of key verticals and tailored solutions that transcended mere futurism.” Their commitment to technological advancement and positive impact, he shared, was reflected in the implementation of “cutting-edge solutions, including cybersecurity, datacenter solutions, hybrid cloud, and SaaS.”

Viren Bavishi, CEO of Sapphire Micro System, succinctly captured the essence of success: “It’s all about agility.” The pandemic, he stated, “showed us that the fastest dancers win the prize,” and those who embraced adaptability and invested in their people emerged as the undisputed champions.

Channel Partners See Boom Times in 2024

An air of aggressive optimism hangs heavy in the IT channel, with a notable 80 percent of partners and solution providers anticipating substantial growth in 2024, defying the conservative estimates of most analysts projecting sustained growth in the 7-10 percent range.

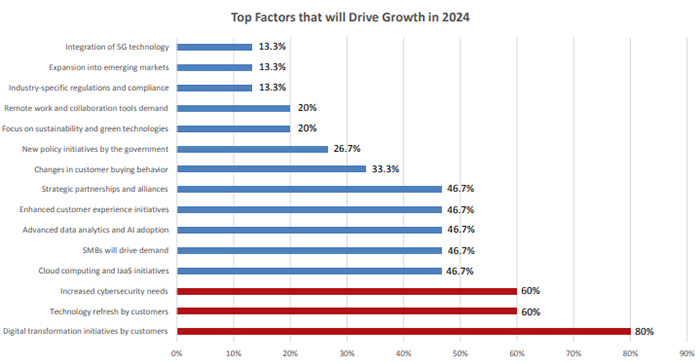

According to the Channel Outlook Survey 2024, a resounding 80 percent of respondents foresee ‘digital transformation initiatives by customers’ as the primary driver of their growth in 2024. Close behind, ‘technology refresh by customers’ and ‘increased cybersecurity needs’ secure the votes of 60 percent of respondents as the top growth factors for the coming year.

Interestingly, the survey reveals that over 46 percent of participants attribute equal significance to various factors shaping their growth in 2024. These include cloud computing and IaaS initiatives, SMB-driven business, advanced data analytics and AI adoption, customer experience initiatives, as well as strategic partnerships and alliances.

Shah of Insight Business Machines shared their strategic focus, stating, “We are actively targeting demand arising from technology refresh cycles and Small and Medium-sized Businesses (SMBs) through intensified solutions for cybersecurity, integration of 5G technology, and efforts in hybrid cloud and Software as a Service (SaaS).”

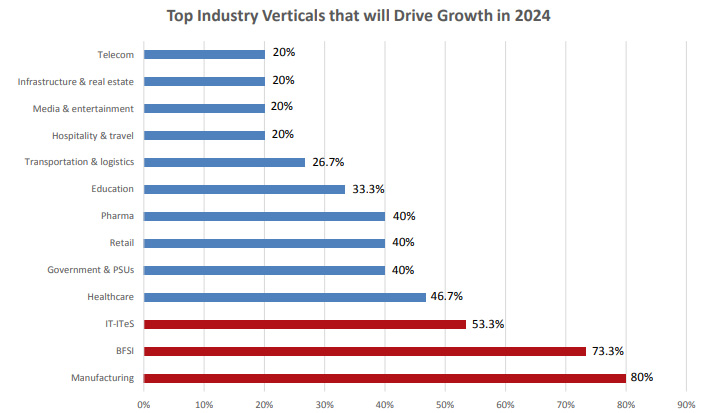

In alignment with the survey results, solution providers are placing their bets on three major verticals in 2024 – manufacturing, BFSI, and IT-ITeS. While acknowledging BFSI as the largest contributor in 2023, 80 percent of respondents expressed their confidence in manufacturing for the upcoming year. Over 73 percent expect BFSI to remain among the top contributing verticals, while 53 percent place their faith in IT-ITeS.

Kaushik Khanna, Co-founder of BluePi, shared their key strategies for 2024, emphasizing, “Our focus includes expanding service offerings, particularly in the areas of data modernization, AI/ML integration, and data analytics. We see significant potential in sectors like BFSI, healthcare, consumer electronics, aviation, retail, and manufacturing, tailoring our solutions to address the specific needs of these industries.”

Prashanth Subramanian, Co-Founder and Director of Quadrasystems, echoed the sentiment, saying, “We are developing industry-specific solutions around verticals such as manufacturing and BFSI, aiming to be even more relevant to our customers for their transformational business outcomes.”

While healthcare is anticipated to be among the top verticals for over 46 percent of solution providers, a close 40 percent are equally focused on government & PSUs, retail, and pharma verticals to drive their growth in 2024.

Key Strategies for IT Channel Growth in 2024

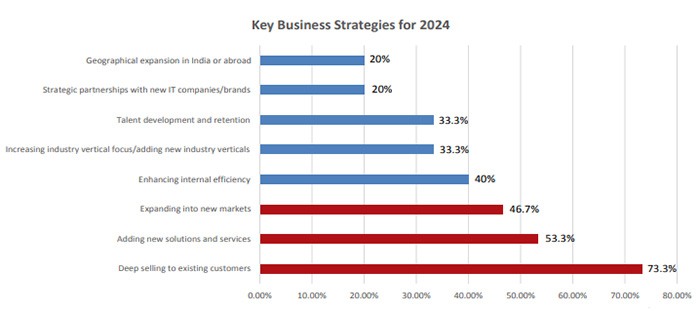

A remarkable 73 percent of respondents emphasize the critical role of deep selling to existing customers for growth in the year ahead. Recognizing the high costs associated with new customer acquisition, the majority aims to expand the wallet share within their existing customer base. More than 53 percent of respondents believe that adding new solutions and services will be a pivotal strategy in 2024, while over 46 percent will concentrate on expanding into new markets.

Shah of Insight Business Machines shared insights into their 2024 roadmap, stating, “In 2024, our strategic priorities focus on continued deep engagement with existing customers. Additionally, we are targeting measures like geographical expansion, intensified industry vertical focus with potential additions, and a meticulous focus on cost-cutting in the year ahead.”

Gurpreet Singh, Founder & Managing Director of Arrow PC Network, highlighted their customer-centric approach, stating, “Embracing a customer-centric ethos, we are prioritizing payment flexibility, ensuring tailored plans that resonate with our clients’ budgets. This approach not only fosters seamless collaboration but also strengthens relationships, driving repeat business and referrals.”

Surprisingly, over 40 percent of solution providers consider ‘enhancing internal efficiency’ as the key business strategy for 2024. Talent development and retention, along with increasing industry vertical focus, are identified as top strategies by over 33 percent of partners for the upcoming year.

Chopra of Team Computers emphasized their investment in upskilling the team, stating, “We are investing in upskilling our team to navigate the intricacies of AI, ML, and edge computing, ensuring that our solutions align with the evolving needs of our clients.”

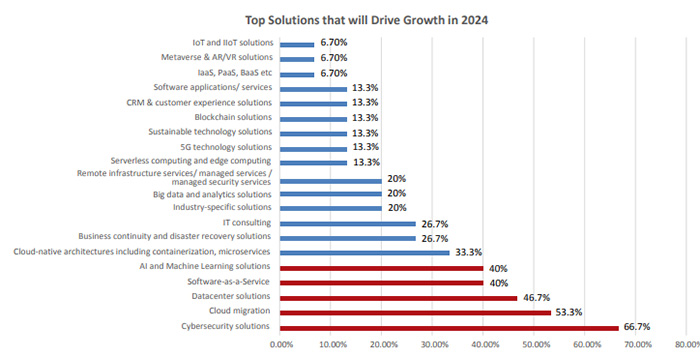

In the solutions arena, cybersecurity leads with almost 67 percent of respondents expecting it to be the key growth enabler in 2024. Over 53 percent of partners voted for cloud migration as their top solution focus area, while data center solutions were among the top priorities for over 46 percent of solution providers.

Anuj Gupta, CEO of Hitachi Systems India, shared their strategic investments, stating, “We are strategically investing in flourishing business units like Security, Cloud, and APM, equipping ourselves to be at the forefront of technological evolution.”

“We’re doubling down on remote infrastructure management, adding a cutting-edge SOC to our NOC, and sharpening our SASE expertise. Security as a service is our top priority for BFSI, healthcare, and IT/ITeS,” added Chandrashekar of Futurenet Technologies.

AI and ML solutions secured the 4th spot with 40 percent of partners voting for them as the top focus areas, while a similar number preferred software-as-a-service as a top solution focus area.

Shah of Allied Digital outlined their technology focus, stating, “From a technology perspective, we intend to focus more on AI, data analytics, cybersecurity, asset lifecycle management, and multi-cloud tools.”

Mahesh Kadam, Marketing Head of Savic Technologies, emphasized their focus on cloud adoption, stating, “With a focus on cloud adoption, initiatives like ‘Rise with SAP’ and ‘Grow with SAP’ are integral parts of our strategy for 2024.”

Ratnakar Kanchan, Managing Director of Lauren Information Technologies, highlighted their key business priority, stating, “Our key business priority will be to advance our expertise in AI & ML solutions, focusing on key industry verticals, including banking, healthcare, and pharma.”

Subramanian of Quadrasystems emphasized their key priorities, stating, “Key priorities for us will be security, modernization, and managed services. AI will be the omnipresent fabric that we will use to weave these solution areas to solve unique customer challenges.”

In this ever-shifting landscape, agility reigns supreme. Nirmal Kumar, Director – Business Solutions, Uniware Systems, expressed their approach, stating, “We listen to evolving customer needs, from scalability to sustainability, and innovate constantly to stay ahead of the curve. That’s the recipe for long-term success.”

Overcoming Challenges in the IT Channel Landscape of 2024

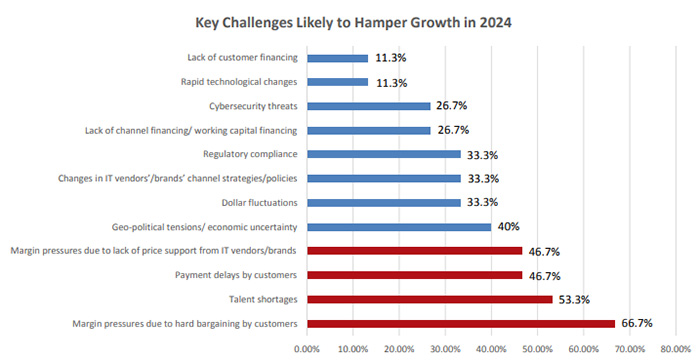

Talent shortage, economic uncertainties, and evolving vendor-channel dynamics cast shadows over the horizon. However, the most formidable challenge? Partners have unequivocally identified ‘margin pressures due to hard bargaining by customers’ as the top impediment likely to hinder growth in 2024, with almost 67 percent of respondents endorsing this concern.

In addition, over 53 percent of partners emphasized the critical nature of the talent shortage as a major challenge. Singh of Arrow PC Network stressed the need for the channel to become a learning organization, stating, “Continuous upskilling will be paramount to navigate the rapid technological shifts we’re witnessing.”

Further complicating the landscape, payment delays by customers and margin pressures stemming from the lack of price support from IT vendors/brands were identified by over 46 percent of partners as significant roadblocks.

Moreover, 40 percent of respondents perceive geopolitical tensions and economic uncertainty as major challenges likely to impede growth in 2024.

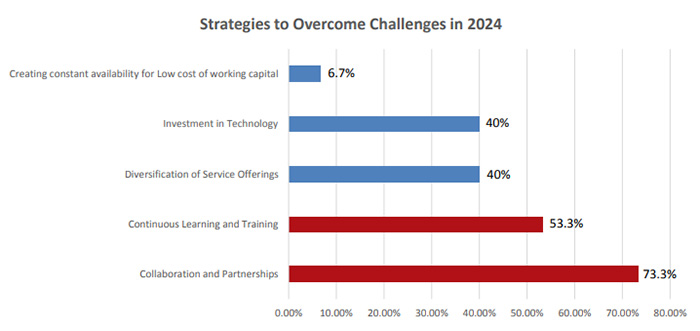

Intriguingly, over 73 percent of respondents view collaboration and partnerships as the strategic response to navigate challenges in 2024. Gupta of Hitachi explained the collaborative approach, stating, “We may partner with some other partners as a joint bid to participate in a large complex customer requirement, especially RFPs. Thus, collaborations enable companies to offer more comprehensive services by combining the specialized capabilities of different partners.”

As anticipated, over 53 percent of partners advocated for continuous learning and training as the means to overcome challenges. Kadam of Savic Technologies outlined the proactive measures required, stating, “IT solution providers may encounter challenges, including talent shortages in emerging technologies, increased data privacy regulations, and the need for seamless integration of diverse technologies. Proactively addressing these involves investing in upskilling programs for employees, staying abreast of regulatory changes, and prioritizing interoperability in solution development. In fact, it’s a marathon, not a sprint, and continuous learning and innovation are the keys to success.”

Partners Demand Enhanced Support, Co-Marketing, and Incentives

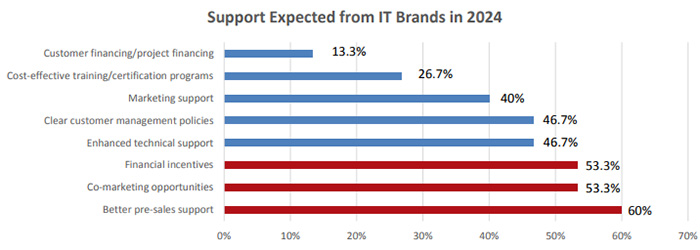

The dynamics between IT vendors and channel partners stand as pivotal elements in the industry’s success. As the IT channel undergoes evolution, so do the expectations from vendors. Channel partners anticipate enhanced pre-sales support, co-marketing opportunities, and financial incentives from their vendors/principals.

“It’s a shared future we’re building,” affirmed Bavishi of Sapphire Micro System. “The closer we work together, the better equipped we are to help businesses thrive in this dynamic digital landscape.”

Certainly, 60 percent of the partners voted for better pre-sales support as the most crucial support from IT brands in 2024. Key expectations from vendors encompass increased support during pre-sales, recognizing the growing need for consultative support, flexibility to bundle service SKUs, and consistent support in training, account management, and communication, as shared by Shah of Allied Digital.

Co-marketing opportunities and financial incentives received over 53 percent of the respondents’ votes each as the desired support from IT vendors. Khanna of BluePi emphasized the importance of clear performance metrics and attractive rewards, stating, “Both the vendor and channel partners should have clear performance metrics in place and offer attractive rewards for exceeding expectations. This motivates both parties to continuously improve and achieve their goals.”

Support in the form of co-marketing opportunities, financial incentives, and project financing is expected in 2024, aligning with the collaborative nature of the relationship, as outlined by Shah of Insight Business Machines. These expectations aim to enhance visibility, drive performance, and seamlessly execute projects.

Moreover, many partners highlighted the necessity for cost-effective training and certification programs as a major expectation. Khanna of BluePi stressed, “We need access to comprehensive training and certification programs to ensure our team is equipped with the latest knowledge and skills. We expect vendors to communicate openly and collaborate closely with us to ensure we both are successful.”

Conversely, some partners identified significant gaps in vendor-channel relations that need addressing. Vipul Datta, CEO of Futuresoft Solutions, emphasized, “OEMs are keen to sell the product and not worried about its use by the client. With changing trends, it’s putting cash flow pressure on the channel ecosystem. Vendors must address the cash flow challenges and take part in the consumption journey.”

“There is still a lot of reseller-based relationship between the channels and the OEM product brands. The customer demands more consultative selling, which means the channels need to invest in deeper skill resources, broader adoption of products within selected OEMs, and continued investment in training. Larger OEM brands will likely continue to consolidate on channel partnerships to provide an improved sales experience to customers,” added Shah of Allied Digital.

“Trust isn’t earned overnight; it’s built upon every open conversation, every reliable milestone, and every shared victory. That’s how we forge lasting partnerships with our vendors and channels,” shared Kanchan of Lauren Information Technologies.

Charting the Course Ahead

The IT channel stands at a pivotal juncture. With a proactive approach to emerging technologies, a commitment to talent development, and a focus on fostering strong vendor relationships, it can not only navigate the uncertainties of 2024 but emerge as a true digital transformation powerhouse. This is no time for complacency. This is the time to embrace adaptability, prioritize value over volume, and collaborate fiercely.

The future belongs to those who dance with the tides, not against them. And the IT channel, with its unwavering resilience and unwavering spirit, is a canvas waiting to be painted with the vibrant hues of innovation. The brushstrokes of 2024 are yet to be laid, and the IT channel holds the palette. Let’s see what masterpiece will it create?

Latest Technology News Today – Get Latest Information Technology Updates and Services Latest Technology News Today – Get Latest Information Technology Updates and Services

Latest Technology News Today – Get Latest Information Technology Updates and Services Latest Technology News Today – Get Latest Information Technology Updates and Services