By Anuj Singhal

The Asia–Pacific channel ecosystem is entering a new era of transformation as artificial intelligence accelerates faster than any technology in recent history and hyperscalers inject record investment into digital infrastructure. Multiple sessions at the Canalys Forums APAC 2025 revealed a clear strategic signal: partners that evolve into AI-driven service organizations will advance, while transactional, margin-dependent players risk falling behind.

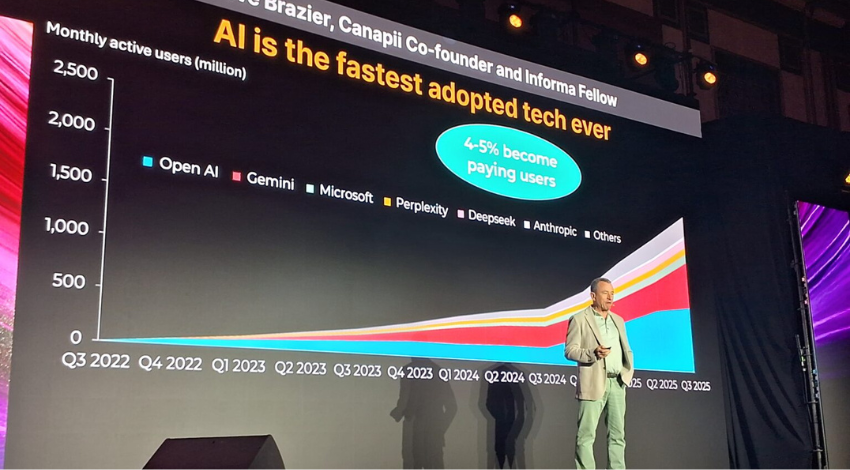

“Opportunity in Uncertainty” — Steve Brazier’s Market Signal. In his keynote, Steve Brazier, Informa Fellow and Co-founder of Canapii, underscored the unprecedented pace of global AI adoption. Speaking in a session titled Opportunity in Uncertainty, he noted that AI is the fastest technology ever adopted, with 4–5 percent of users converting into paying customers a rate that far surpasses earlier digital waves. Consumers are proving willing to pay for premium AI services, enabled by rapid innovation cycles from companies such as OpenAI, Gemini, Microsoft, Perplexity, Deepseek, and Anthropic. Brazier highlighted that hyperscaler capital expenditure has become the backbone of this growth. In 2025 alone, hyperscalers committed a record USD 616 billion in CapEx. AWS, Google, Meta, and Microsoft accounted for USD 361 billion of this total, as demand for high-performance compute, GPU capacity, sovereign cloud, and AI workloads continues to surge. Sovereign AI investments are projected at USD 75 billion, while neocloud providers will invest an estimated USD 181 billion to expand AI-ready platforms.

Two-Speed Channel Reality Sheena Wee on Partner Divergence

Sheena Wee, Principal Analyst at Omdia, speaking at the forum, said the APAC channel is now operating at two distinct speeds and the gap is widening every quarter. Some partners are rapidly scaling with high-growth technologies, new consumption-based vendor programs, and AI services. Others are slowing down due to shrinking incentives, tighter margins, and increasing operational complexity. Wee emphasized that vendor programs, go-to-market strategies, and transactional incentives are simultaneously fueling growth and triggering consolidation. Currency volatility remains a major concern for partners, affecting pricing, profitability, and planning cycles. In this climate, she said, vendors must clearly communicate the business value they deliver to partners, not just product features or margin tables.

AI Capabilities Become Core Channel Differentiators

According to Omdia insights presented at Canalys Forums APAC 2025, 49 percent of channel partners are currently developing AI use cases and customer solutions, reflecting a decisive pivot toward innovation. Partners are:

- Building internal AI skill sets

- Investing in AI-led transformation of their own operations

- Creating virtual demo labs and pre-configured solution environments

- Pursuing specialized M&A for AI competency building

The message is clear: experimentation is giving way to structured AI solution development. Ability to respond quickly to AI-driven customer needs is no longer optional — it is a prerequisite for pipeline and profitability through 2026–2028.

APAC-to-APAC Service Delivery to Triple by 2028

One of the strongest forecasts revealed at the event was the growth of cross-border service delivery within the APAC region. By 2028, the number of APAC partners providing regional service delivery will triple, driven by:

- The rise of regional delivery hubs

- Demand for consistent service quality across multiple markets

- Multinational enterprises seeking integrated capabilities

Wee said vision, specialization, collaboration, and geographic positioning will determine which partners gain competitive advantage in this new delivery landscape.

The Road Ahead — Specialization Beats Scale

The Canalys APAC forum narrative shows a channel ecosystem split between acceleration and rationalization. Partners that lean into specialization especially in AI, governance, cross-border delivery, cybersecurity, and modernization services are positioned for rapid expansion. Those tied to legacy resale or first-level transactional models may confront contraction and consolidation pressures.

As AI reshapes customer expectations and hyperscale investments redefine digital infrastructure, the winning equation for APAC partners will be:

AI + Services + Regional Delivery + Vendor Alignment.

The Canalys 2025 messaging landed a decisive conclusion: uncertainty is real, but so is opportunity and the future of channel growth will be created by those willing to pivot early and invest in AI-ready service capability.

Latest Technology News Today – Get Latest Information Technology Updates and Services Latest Technology News Today – Get Latest Information Technology Updates and Services

Latest Technology News Today – Get Latest Information Technology Updates and Services Latest Technology News Today – Get Latest Information Technology Updates and Services